In investing, going with logic is easy to say but tough to do. The psychological biases in our minds force our intellect to think in the wrong direction by abandoning logic. These mental shortcuts can muddy the waters and steer us into pricey blunders.

You've probably heard the saying “To defeat your enemy, you must know your enemy.” So knowing and admitting these biases exist is key for anyone hoping to sail through the markets smoothly.

So let's get started. Here I have mentioned some very common psychological pitfalls and share simple tips to avoid them.

7 Biases That Holding You Back From Being An Intelligent Investor

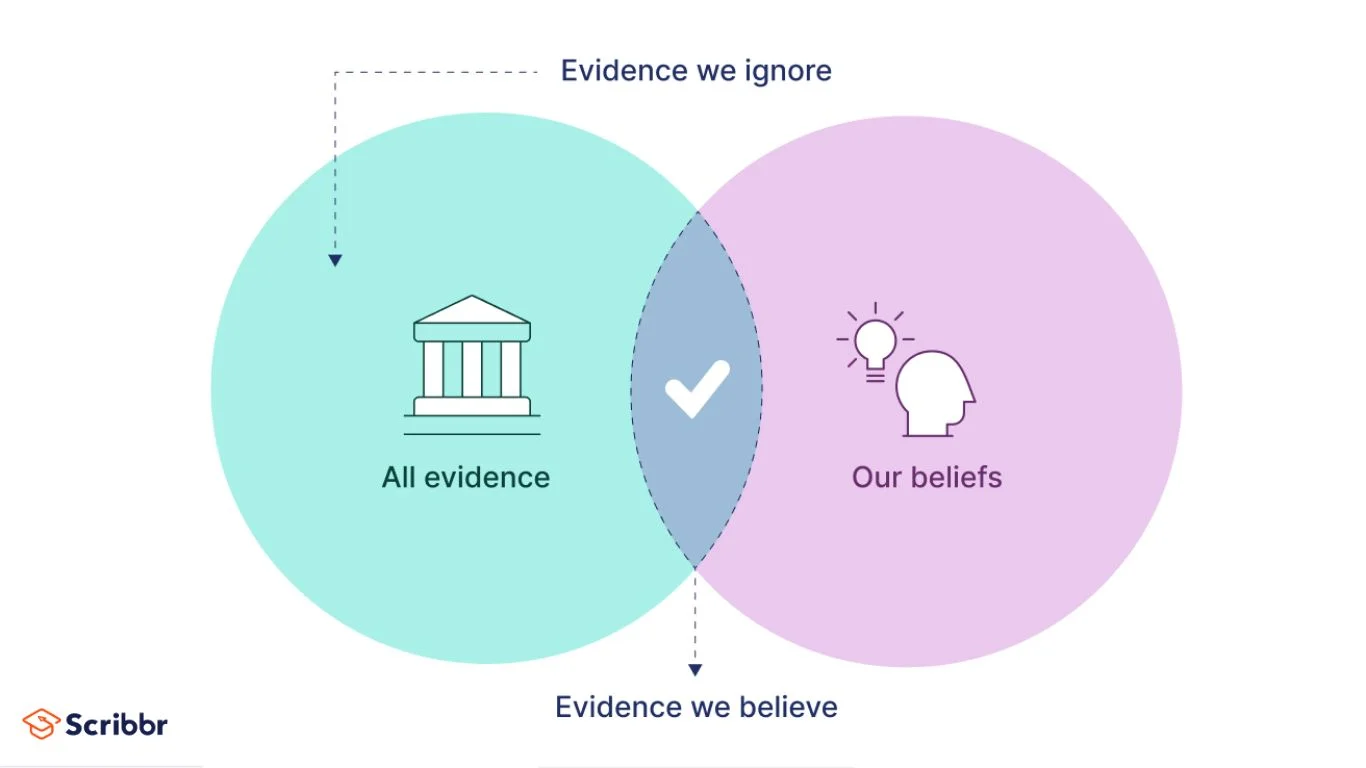

1. Confirmation Bias

Confirmation bias is like wearing tinted glasses that make everything look the way you want it to. It's when we look for, interpret, and remember information in a way that fits what we already believe. In investing, this means we tend to seek out information that agrees with our thoughts about a stock or market trend while brushing off anything that contradicts us.

How to Avoid It: Challenge yourself! Seek out opinions that don't match yours and weigh them up. It's like getting a second opinion from a different doctor before deciding on a treatment.

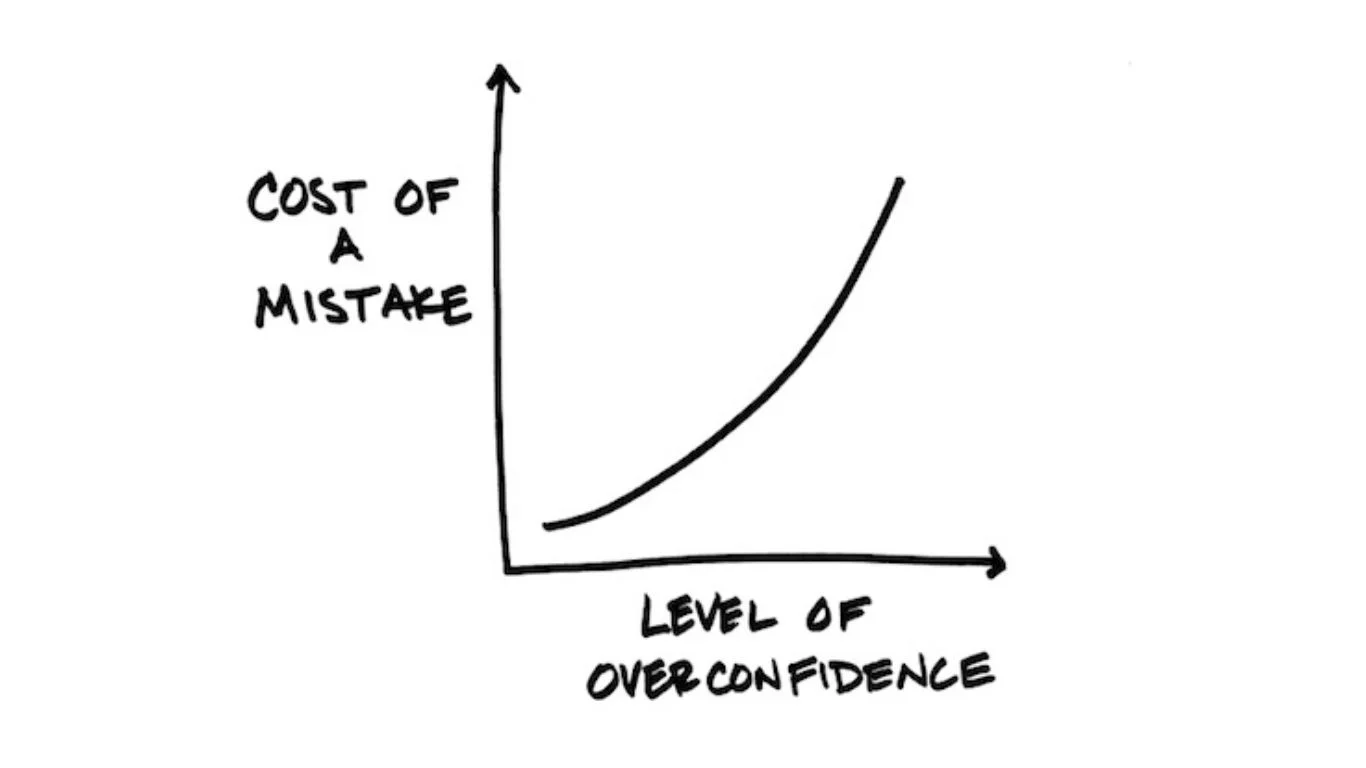

2. Overconfidence Bias

Overconfidence bias is like thinking you're the master of investing when you might be a sidekick. It happens when investors think they know way more than they do and believe they can predict outcomes like fortune tellers. This can lead to trading too much, not spreading out investments enough, and you take more risks than you should.

How To Avoid It: Keep yourself grounded and recognize the limitations of your knowledge. Trust data and analysis over gut feelings. There's no shame in asking for advice when you're not sure.

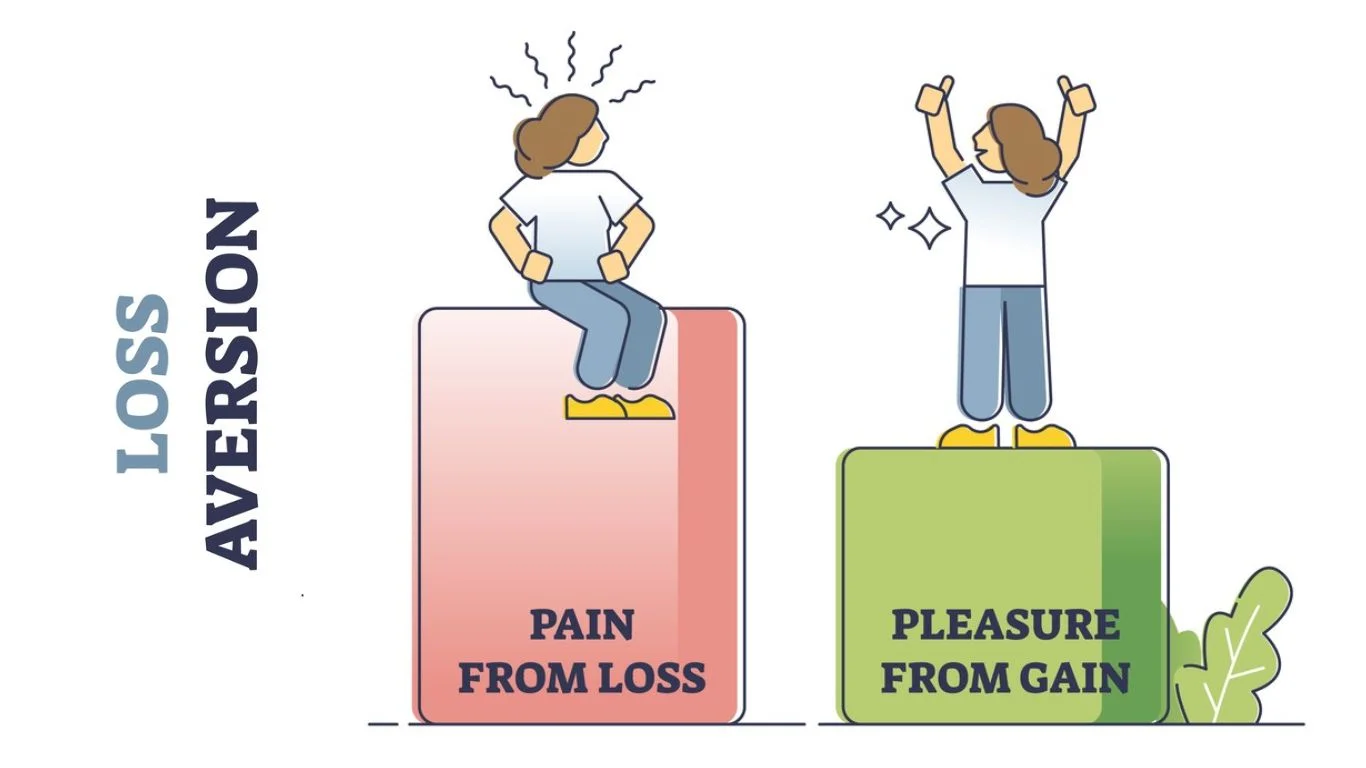

3. Loss Aversion

Loss aversion refers to the tendency to prefer avoiding losses over acquiring equivalent gains. It's like holding onto a sinking ship, hoping it'll magically float again. Investors often hold onto losing investments for too long, hoping they will recover, even when evidence suggests otherwise.

How To Avoid It: Set clear criteria for selling investments and stick to them. Implement stop-loss orders to automatically sell assets if they fall below a certain threshold, helping to prevent emotional decision-making. It's like having a safety net to catch you if things go south.

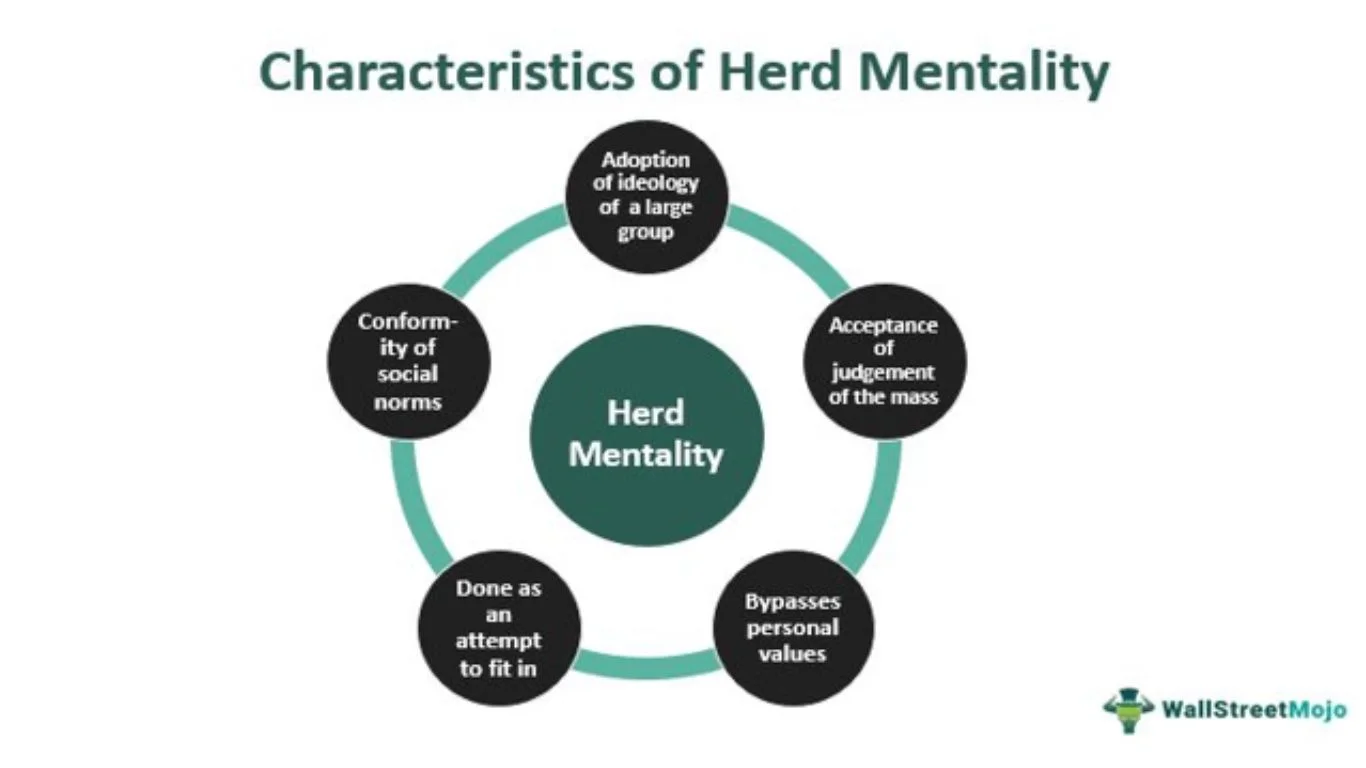

4. Herd Mentality

This mindset is like a wildfire, spreading through everyone nowadays. It's dangerously liberal, blindly embracing every extravagant whim without a second thought. In investing, It happens when investors blindly follow what everyone else is doing, without stopping to think for themselves. This can spark bubbles in asset prices, trigger market-wide panic, and fuel irrational excitement that's not grounded in reality.

How To Avoid It: Do your homework! Make decisions based on your own research, not just because everyone else is doing it. And surround yourself with a diverse bunch of thinkers who'll challenge your ideas.

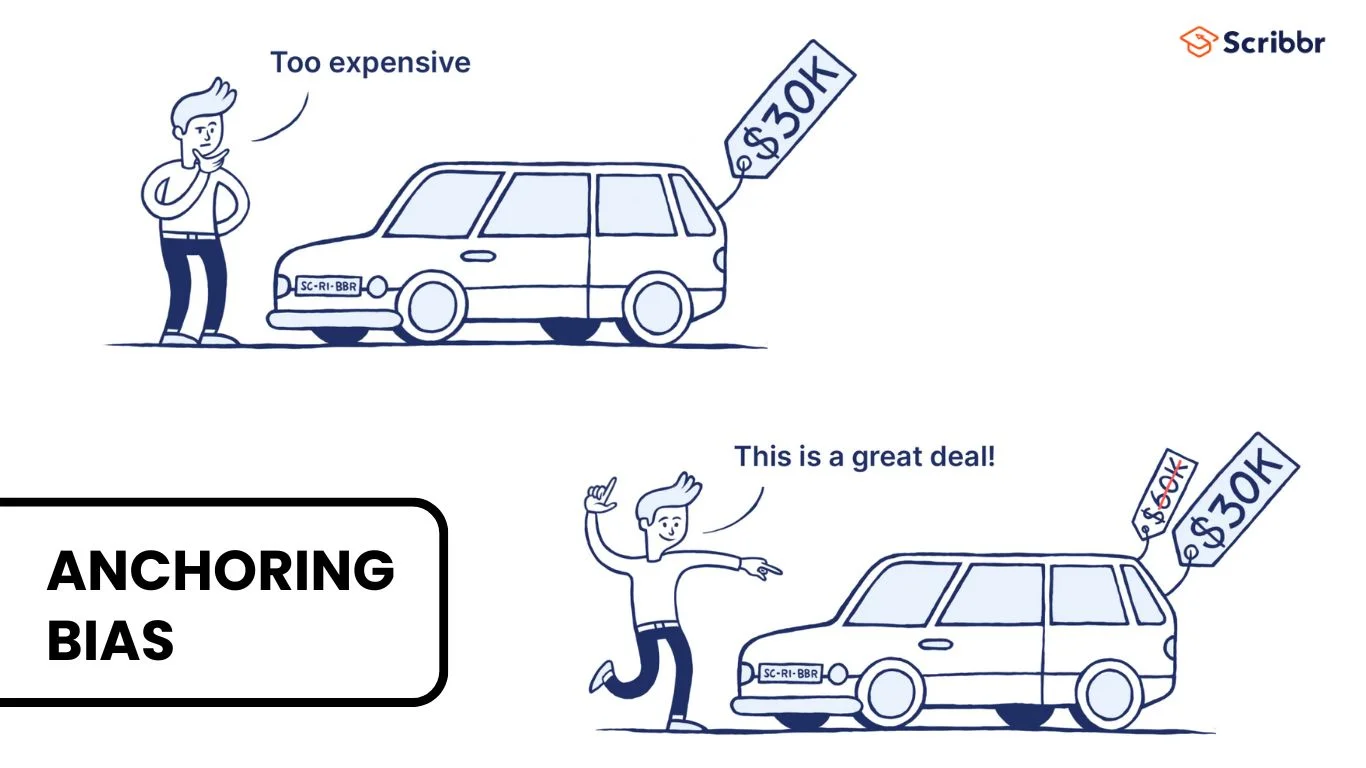

5. Anchoring Bias

Anchoring bias grips you like a vice, chaining your decisions to the first nugget of information you stumble upon. Investors get shackled to a specific price or valuation, blinding themselves to any fresh data that challenges their initial judgment. This can lead you to miss good opportunities and make bad decisions.

How To Avoid It: Keep an open mind! Stay flexible and be willing to adjust your thinking as new information rolls in. It's like being a sailor who adjusts the sails when the wind changes. Avoid becoming emotionally attached to specific price targets or valuation metrics.

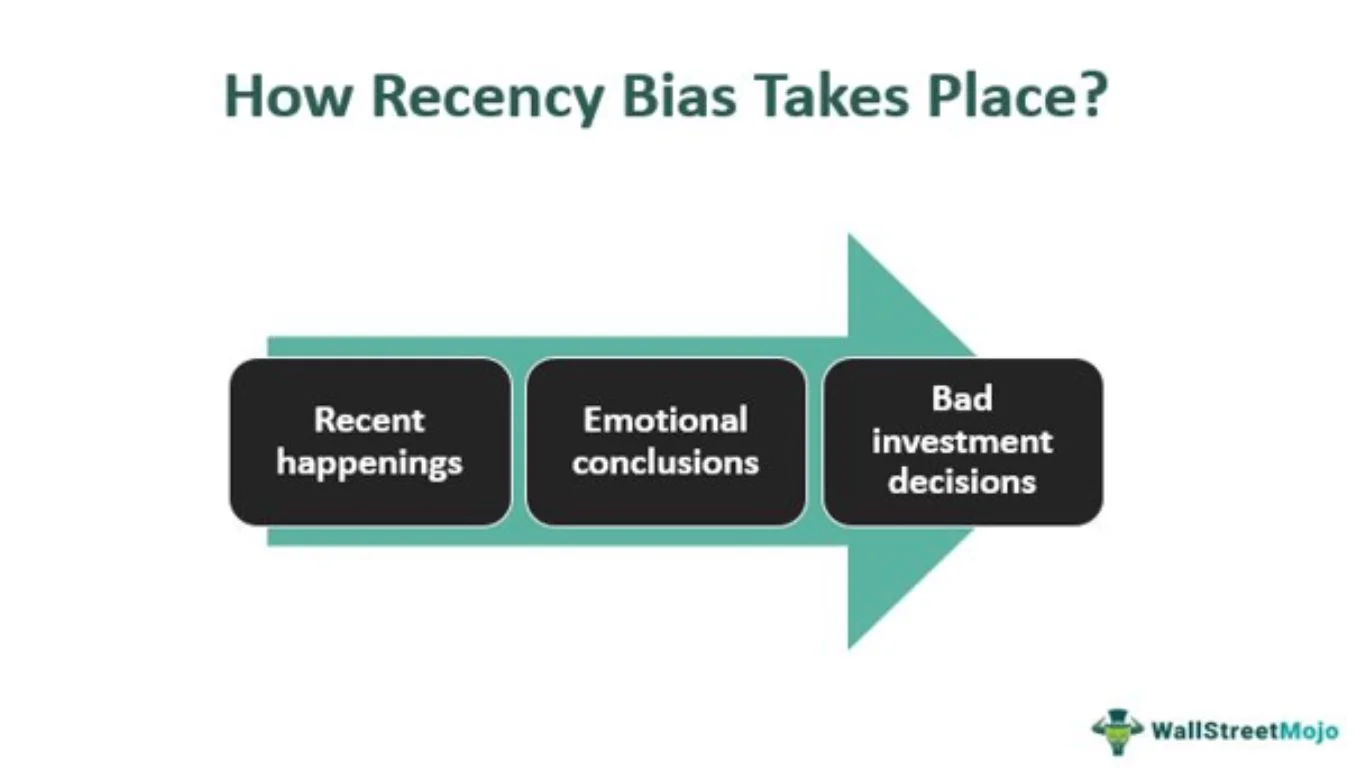

6. Recency Bias

This bias can hack your brain, throwing history out the window and fixating on the latest gossip. Recency bias causes you to ignore historical data and make wrong decisions by giving more weight to recent events. Investors may conclude short-term trends into the future without considering long-term fundamentals. If you follow this bias, you will never experience the power of compounding.

How To Avoid It: Take a step back and look at the bigger picture. Avoid making knee-jerk reactions to short-term fluctuations. Consider both recent events and long-term trends before making your move.

7. Gambler's Fallacy

The gambler's fallacy is like a contagious fever, infecting minds with the false notion. It happens when we believe that past outcomes somehow affect future results, even when each event is completely different. Investors might fall into this trap, thinking that a string of losses means a win is just around the corner, or that a series of wins guarantees more success in the future. But in reality, each investment decision stands on its own, and past results don't predict future performance.

How To Avoid It: Remember, each investment is its own game. Refrain from falling for the trap of thinking your luck's about to turn around just because things haven't gone your way recently. Avoid making investment decisions based on perceived patterns or trends that lack a rational basis.

Conclusion

The difference between successful investors like Warren Buffett and Peter Lynch and us is that they do not let these psychological biases dominate them. This is what makes them successful. So by being aware of these biases and taking steps to counter them, you can make smarter, more logical decisions.

Remember to stay disciplined, listen to different viewpoints, and rely on facts rather than feelings. This approach helps you handle the challenges of investing more effectively and boosts your chances of reaching your financial goals over time.

You May Also Like: