When India went into lockdown in March 2020 due to the coronavirus, I had the opportunity to learn a lot about the stock market, mutual funds, and finance during those three months of lockdown. On April 19, 2020, I opened an account with Groww and purchased my first mutual fund. Since then, I have been associated with Groww and have not even considered switching to any other broker.

I have been using Groww for almost 4 years now, so I think, I am fully eligible to give a review of it. Let me share with you my experience with Groww and its pros & cons.

About Groww Company

The beginning of Groww was just like every successful business, born out of a problem. 4 Flipkart employees, Lalit Keshre, Harsh Jain, Ishan Bansal, and Neeraj Singh, faced two problems in India's financial and investing products - complexity and lacked transparency. As a solution to these problems, they introduced Groww to the people in 2016.

They have made their product so simple and easy to use that even newbies can easily start their investing journey. Groww has focused entirely on simplicity and excellent UI/UX. However, I did feel a lack of transparency in the beginning.

Today, Groww has become a significant company with over 1400+ employees and more than 40 million users. Several large investors from around the world have invested in it, such as Tiger Global, Ribbit Capital, and Combinator. In 2022, even Microsoft CEO Satya Nadella invested in Groww.

However, this company is still running at a loss. Its financial performance for the last six years is given below.

| Year | Revenue (in INR crores) | Net Profit (in INR crores) | Net Profit Margin (%) |

| FY18 | 55.2 | -1.3 | -2.4% |

| FY19 | 83.6 | -1.1 | -1.3% |

| FY20 | 147.4 | -3.8 | -2.6% |

| FY21 | 282.9 | -21.6 | -7.6% |

| FY22 | 427.2 | -239 | -55.9% |

| FY23 | 1277 | 448.7 | 35% |

| FY24 | 3,144.98 | -805.45 | -25% |

What I Liked The Most:

1. Fast & User-Friendly Interface:

One of the standout features of the Groww app is its user-friendly interface. Navigating the app is seamless, with intuitive menus and clear categorization of investment options.

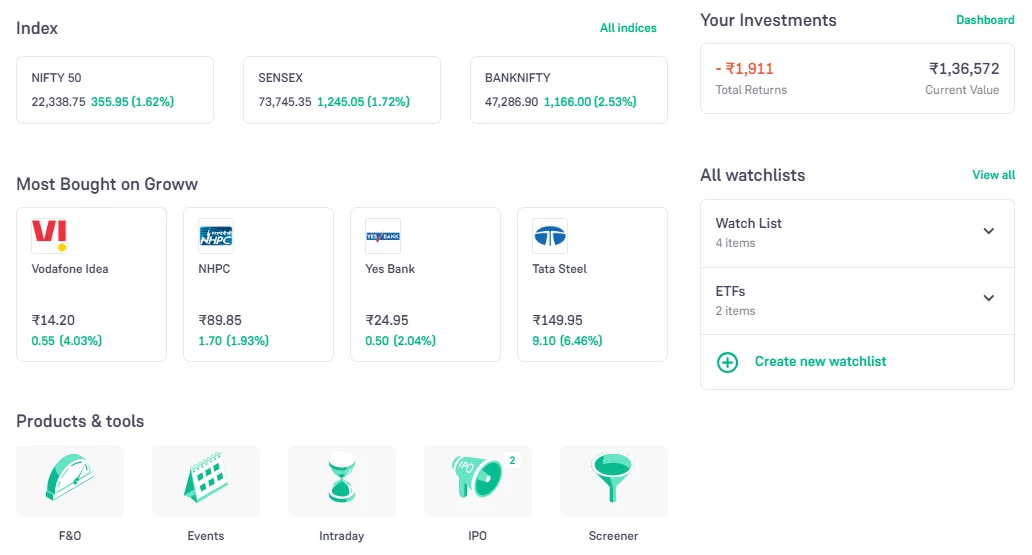

The UI of Groww is like an e-commerce store where stocks' logos, names, and pricing are displayed quite clearly. Additionally, on the main page, you can find indices, current portfolio status, IPOs, and watchlists. Whether you're a novice investor or a seasoned pro, the app's simplicity makes it easy to explore.

2. Simple & Detailed Stock Overview:

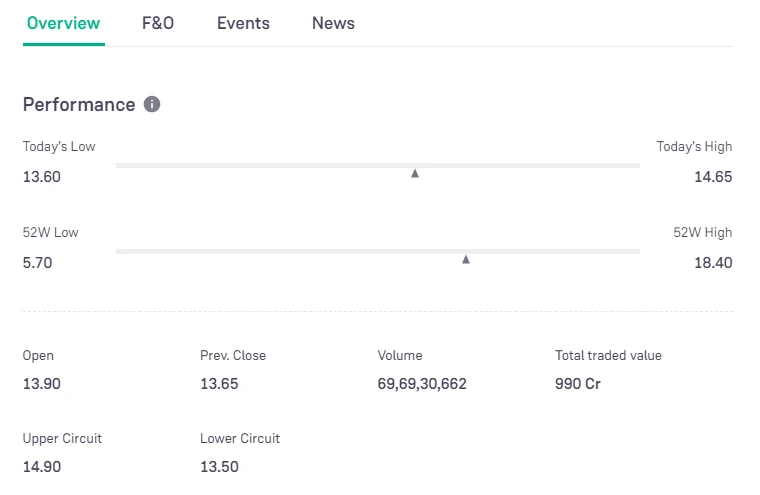

If you want to analyze a stock, you don't need to go anywhere else. In the Groww app, you can find important company events such as upcoming AUM meetings, bonuses, and dividend announcements all in one place.

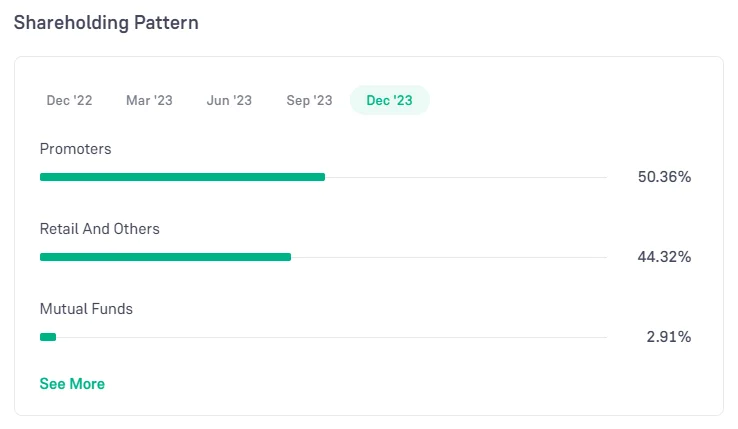

In addition, important fundamental ratios of the stock such as PE ratio, Debt to Equity, EPS, ROE, Book value, Face value, and dividend yield can all be found on the stock overview page. Also, the financials and holding status of the stock are displayed in a very effective way using bar charts. This is very easy to understand for any new investor.

3. Diverse Investment Options:

Groww offers a wide range of investment options, catering to different investment goals and risk profiles. From Mutual Funds, SGB Gold Bonds, Exchange-Traded Funds (ETFs), stocks, and Initial Public Offerings (IPOs) to US stocks, they provide a diverse set of choices to suit individual preferences.

4. Simple Login & No AMC:

While brokers like Zerodha and Paytm Money charge an Annual Maintenance Charge (AMC) of 300 rupees, Groww has no AMC charge. In addition, most brokers provide IDs and passwords for login, but Groww offers a one-time Google login option with the added security of a 4-digit PIN. This makes the login process easier and eliminates the need for repeated logins.

5. Other Handy Features You Might Have Overlooked:

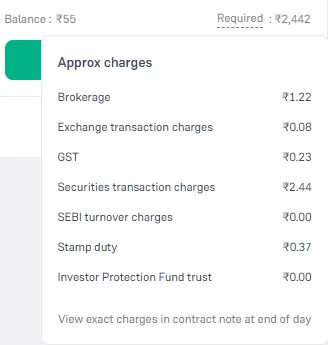

Approx Charges: Here, you can see all the charges you'll incur when you buy or sell a stock, like GST, brokerage, STT, exchange transaction charges, and more. This will help you understand how much funds will be required to buy any stock.

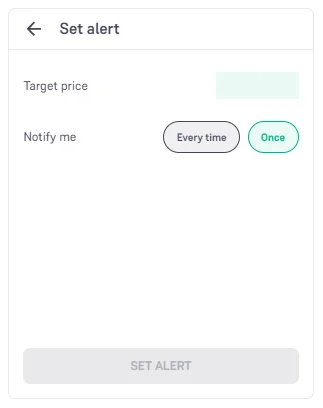

Price Alert: By using this feature, you can track the price of a stock. You just need to set a price, and when that price is reached, you will receive a notification.

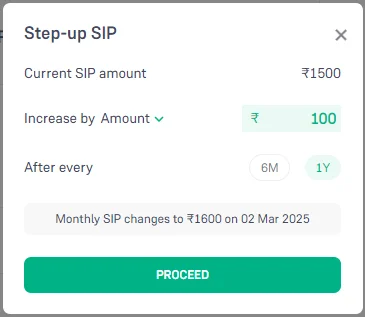

Step-up SIP: With this feature, you can automatically increase your SIP amount either based on a fixed value or a percentage during a 6-month or 1-year time period.

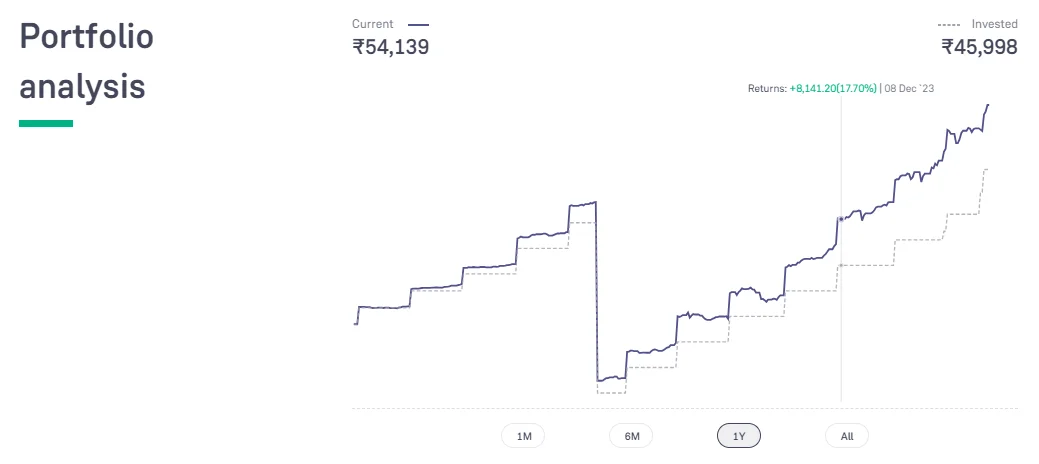

Mutual Fund Portfolio Analysis: Here, you can analyze your current mutual fund investment through easy-to-understand visualizations and reports. You can view a graph of current value vs invested amount and see asset allocation based on sector, market cap, and companies. In addition, you can also access capital gains tax reports.

Unfortunately, the portfolio analysis feature is not currently available for stock portfolios, which is very disappointing. This is a basic and important feature that is crucial for users.

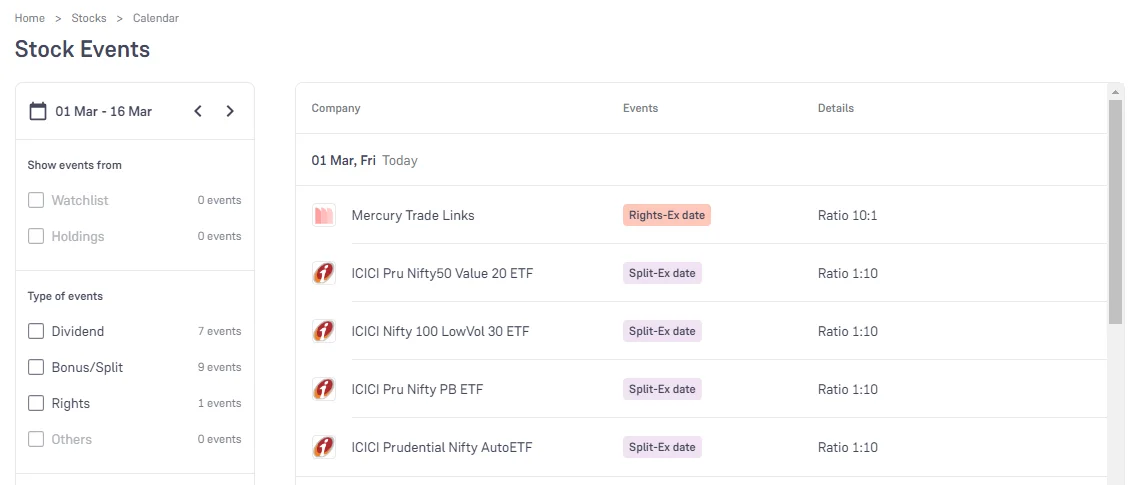

Stock Event Calander: The Groww has now added a new and very useful feature of a Stock Events calendar. Here, you can find out upcoming events related to stocks added to your particular watchlist and those in your holdings.

Additionally, various events such as dividends, stock splits, etc., can be filtered. Try it yourself to discover more features.

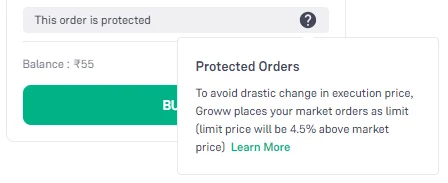

Protected Orders Feature: Sometimes, unexpected fluctuations in the market price can lead to significant losses when we place orders at market price.

To address this problem, Groww has introduced a simple yet very important security feature. It automatically converts your placed market orders into limit orders, and if the market price suddenly rises by more than 4.5% from the current price, the order will not be placed. This protects you from unforeseen market fluctuations.

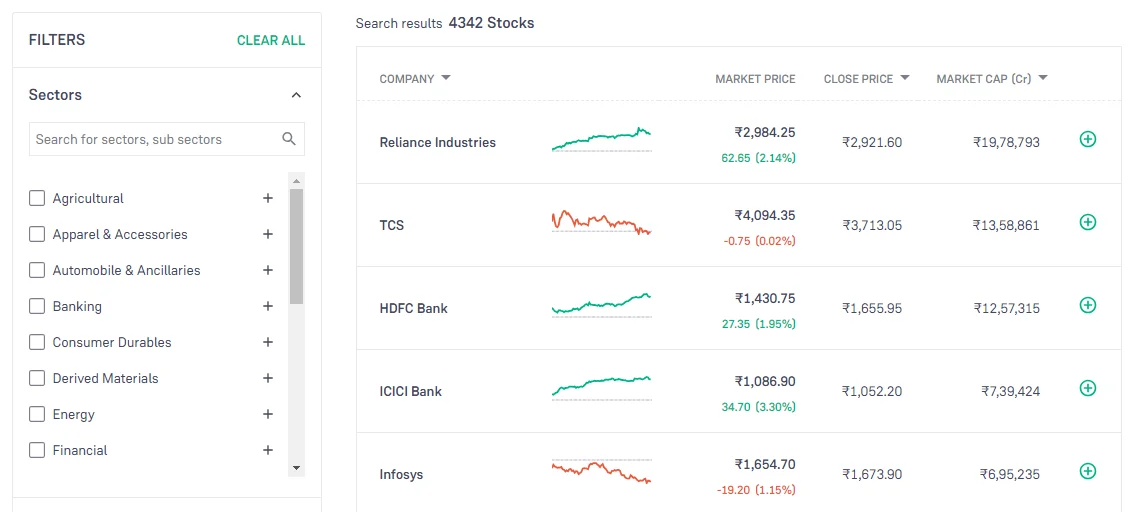

Stock Screener: I consider this stock filter to be the pocket version of a stock screener. Here, you won't find options to filter by ratio as in an advanced screener. However, you can filter stocks by sector, market capitalization, price, and index.

Daily Mutual Fund And Stock Portfolio Update Notification: You can enable this feature with the below-mentioned instruction. This way, you will continue to receive notifications for the ups and downs that occur in your portfolios on a daily basis. Just follow this: Tap on Notification Icon > Click on View All > Go to Manage Notification > Change setting in Notification Manager.

UPI: Groww recently added the UPI payment option to their mobile app. This will give us an even more seamless experience.

6. Educational Resources:

Investing can be complex, especially for beginners. Groww understands this and offers a range of educational resources to enhance financial literacy. The app provides articles, videos, and tutorials on various investment topics, helping users understand the fundamentals of investing, develop investment strategies, and stay informed about market trends.

Things That Need Improvement:

1. Customer Support:

Due to being a discount broker, their customer support is quite poor and slow. After complaining, they respond quite late. However, they are continuously trying to improve their support, but don't expect too much. As an investor, you may not need customer support as much, but if you are a trader, you may face more problems.

2. No Advanced Features:

It has been almost 2 years since Groww introduced stocks, but many features are still missing such as bracket orders, cover orders, after-market orders (AMO), stock portfolio analysis and more. These are all small features that Groww should provide quickly.

3. Some Technical Glitches:

Some users have reported experiencing technical glitches on the app. As an investor, technical glitches may not make a big difference to you. But if you are a heavy trader, you need to keep this weakness of Groww in mind. Even small glitches can cause significant losses for you.

4. No Commodities & Currency Trading Option:

Although Groww offers investment options from the Indian stock market to the US stock market and equity derivatives trading such as futures and options. But the option for commodity and currency trading is still missing.

Conclusion:

In my opinion, you should definitely try Groww once because there are no account opening charges and zero AMC charges, its completely free. I have been using Groww for 4 years and I have not felt the need to switch to another broker or open another account. Therefore, try it once and see if it suits you or not.

I have shared all my personal experiences with Groww through this blog, including what I liked and disliked, and put it in front of you. So I think, if you want to go with any discount broker, then definitely consider Groww. But if you're trader, then I recommended to go with full service brokers.

You May Also Like:

- How To Analyze Stocks Portfolio Before Investing? (Free)

- Top 5 Websites That You Must Use to Analyze Stock For Free

- 4 Simple Steps To Find Undervalued Stocks (Using Screener)

Sources: outlookindia.com, groww.in, thehindubusinessline.com

FAQs:

Yes, the Groww app is safe. It follows SEBI regulations, and the stocks in your portfolio are held by government depositories like CDSL, not by Groww itself, ensuring your investments are secure. Additionally, the app offers security features such as 4-digit PIN login and market protection for orders.

Some disadvantages of Groww include slow customer support, the absence of advanced trading features like bracket orders and cover orders, technical glitches, and no options for commodities or currency trading. Additionally, the company recently became profitable after 8 years since its founding, but there's no guarantee it will maintain profitability in the coming years.

Groww is a SEBI-registered stockbroker and adheres to the required guidelines for stock market operations in India. However, as it primarily deals with stocks and mutual funds, RBI approval is not applicable in this case.

Both platforms have their own strengths. Groww is known for its simple and user-friendly interface with no AMC charges, making it ideal for beginners, while Zerodha offers more advanced features, including bracket and cover orders, which are beneficial for seasoned traders.

Yes, Groww is excellent for beginners due to its easy-to-navigate interface, simple stock analysis tools, and educational resources that help new investors understand the basics of investing and financial markets.

No, there are no monthly charges in Groww. It does not charge an Annual Maintenance Charge (AMC) either, making it cost-effective for investors.

Yes, Groww has been operating at a loss since its inception, with its financials showing net losses for several years. However, it turned profitable in FY23 with a net profit of INR 448.7 crores after years of losses.