You know, I've always been curious about how to measure the potential returns of a bunch of hand-picked stocks over the next 3 to 5 years.

So to break down the problem, I began exploring many portfolio analysis tools and websites on Google and YouTube. I spent a considerable amount of time, approximately 1.5 to 2 years, periodically conducting research. Finally, I found a website that proved to be useful for me. It really helped me analyze my self-made stock portfolios.

First of all, let me tell you that I have written these blogs for people who want to hold a bucket of 18-20 stocks chosen by doing research and fundamental analysis for the long term around 5 to 10 years or more. That means this blog is only for real intelligent investors.

What Advantages Can You Expect From This Tool?

- You will be able to estimate the potential returns of your chosen stock basket in the coming years.

- You can determine whether your custom portfolio can outperform mutual funds or the returns of the Nifty index.

- If any stock underperforms, You will already know.

- You will know how much you are investing in large-cap, mid-cap, or small-cap companies.

- This website will also indicate through a chart what percentage you are going to invest in which industry. So you will get help in portfolio diversification.

- Seeing the returns, your confidence in your chosen stocks will increase, motivating you to stay invested for the long term.

After knowing the benefits of this website, let's find out how you will use it.

How To Analyze Your Virtual Portfolio Analysis?

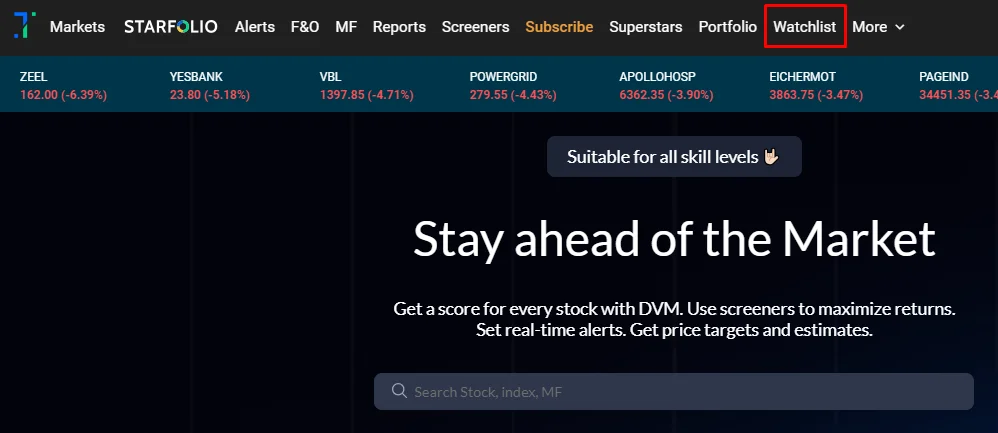

Step 1: First, you will need to create an account on trendlyne.com. Then, add the list of your favorite stocks to the Watchlist. This website provides a free portfolio analysis tool.

Step 2: To add stocks, click "Watchlist" from the menu.

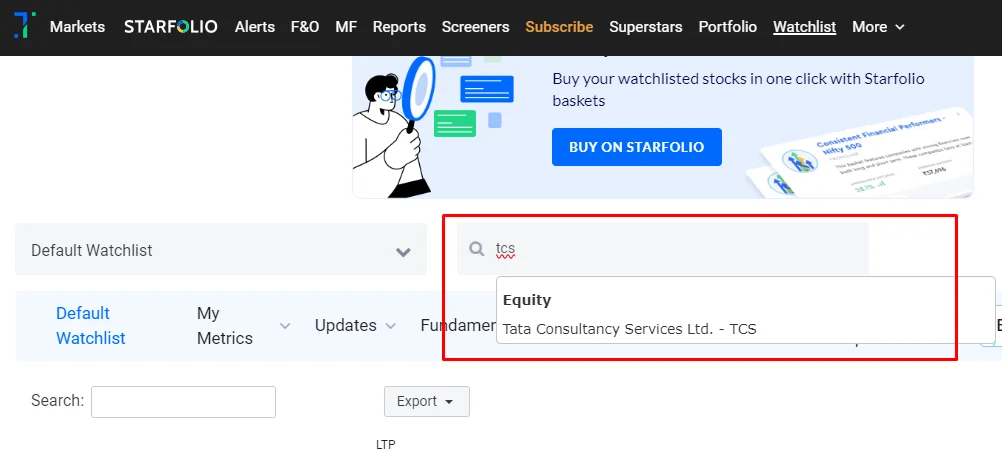

Step 3: There you will see the "Add Index/Stock" input box. You can type the names of stocks and add any stock to the Watchlist by typing the company’s name.

I suggest that you should have no more than 20 or even fewer than 15 stocks in your Watchlist. This way, you avoid over-diversification or over-concentration mistakes.

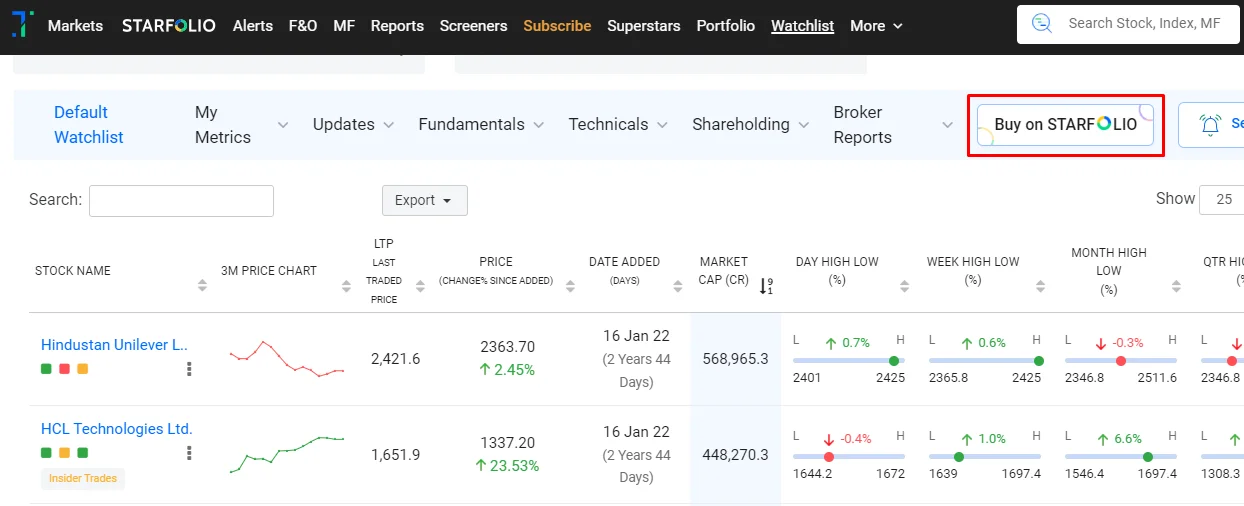

Step 4: After adding all stocks to your Watchlist, you will see a button labeled "Buy On STARFOLIO." Click on it.

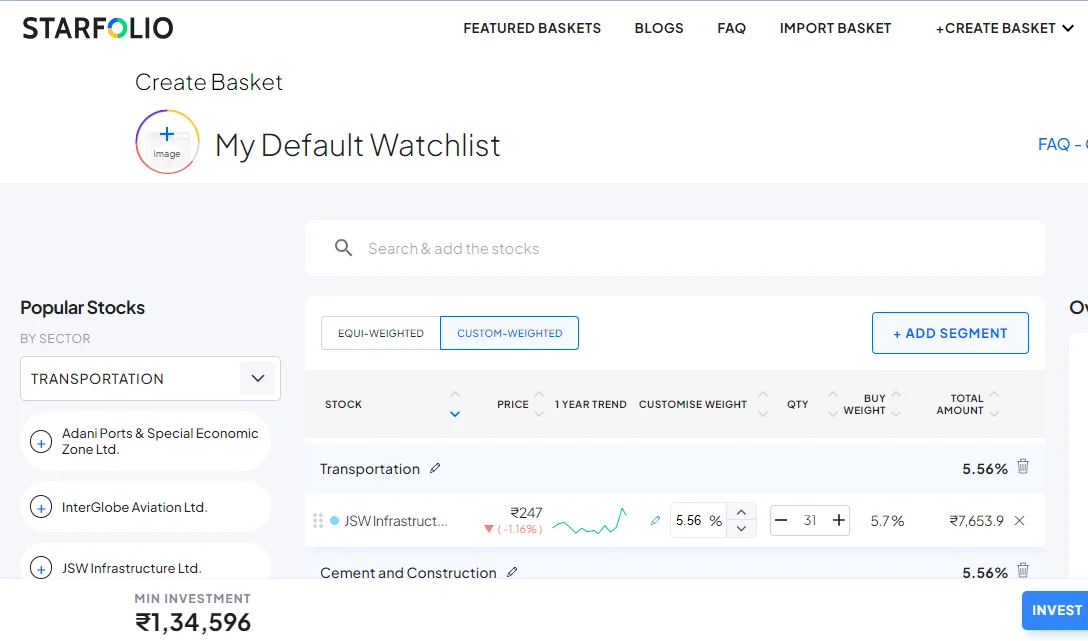

Step 5: By clicking on it you will be redirected to a new page. There you will see the screen shown in the screenshot below.

Here you can distribute equal capital to all stokers or give your own custom weightage. Below will also show you the minimum amount to invest in all stocks.

You can also add new stocks from here.

How To See Virtual Portfolio Forecast:

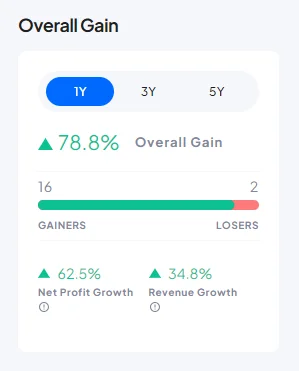

On the right side of the stock list, you will find the overall return of your portfolio. Here, you can view the expected return from 1 to 5 years. Additionally, you will also find the Net Profit Growth and Revenue Growth of all companies.

At the bottom of the stock list, you will find the Basket Analytics field. Here, you can view Stock Basket vs Nifty graph, portfolio by market capitalization, sector, segment, and the company’s earnings growth.

Final Words

By following the simple steps shown in this blog, you too can conduct an inspection or analysis of your stock basket and estimate its durability and long-term growth potential.

You May Also Like: