Intrinsic Value By Benjamin Graham Model

Our intrinsic value calculator works on Benjamin Graham Model. You may know Benjamin Graham who is also known as the "father of value investing". He introduced this formula in his book “Security Analysis” in 1962 and later made some modifications to it in 1974.

Valuation

Famous As A…

Benjamin Graham is known as the "father of value investing" and the "Dean of Wall Street." He was a true value investor who applied what he taught. For example, he approached investing with a highly unemotional and mathematical mindset.His books "Security Analysis" and "The Intelligent Investor" are so valuable today that many investment firms require any newly hired fund managers to read them.

Additionally, Graham challenged the globally accepted gold standard. He suggested a new U.S. and global currency system that did not rely solely on gold. His idea was to base the currency on a mix of different commodities or commodity baskets. It could protect the economy from inflation more effectively and bring stability. However, due to the complexity of implementation, these ideas were never adopted

The Ideology & His Achievement

Benjamin Graham pioneered a new investing philosophy emphasizing independent thinking, emotional detachment, and security analysis. He explored the concept of value investing, where the value of a stock is determined by the underlying business rather than its market price.

Graham advised investors to approach stock purchases with the mindset of owning a business rather than just buying stocks. He reinforced this idea in his book by stating, "Investment is most intelligent when it is most businesslike."

He consistently advocated for focusing on a company's financials and reasoning rather than following market sentiments or public opinions. Graham famously said, "You are neither right nor wrong because the crowd disagrees with you, but you are right because your data and reasoning are right."

Benjamin Graham, for the first time in his book "The Intelligent Investor," explained the difference between real investing and speculation. He says…

"An investment is something that, after careful study, ensures the safety of your money and provides a good return. If it doesn't meet these standards, it's considered speculation."

That's why Warren Buffett hailed this book as "the best book about investing ever written."

Benjamin Graham's concept of Mr. Market is well-known. Besides he also explains the stock market in another way. Graham explain…

In the short term, stock prices can be influenced by popular opinion and emotions, like a voting machine where people's choices can make prices go up or down. However, in the long term, the stock market acts like a weighing machine, where the true value of a company is what ultimately determines its stock price.

Benjamin Graham proved his title as the "father of value investing" by consistently achieving good returns with his investing strategy over a long period.

From 1936 to 1956, he achieved an annualized return of approximately 20% over 20 consecutive years, while the overall market performance during the same period was 12.2%. He consistently beat the market returns for 20 years straight.

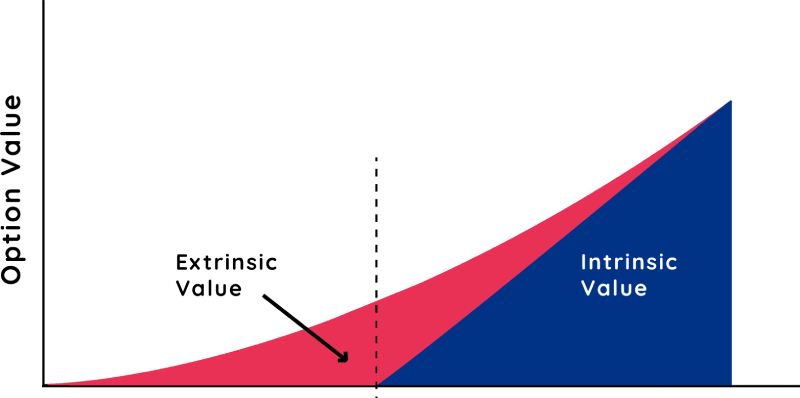

Discovery Of Intrinsic Value & Margin Of Safety

Benjamin Graham was one of the first to introduce the concepts of Intrinsic Value and Margin of Safety in investing and the stock market. These concepts make us consider whether a stock is often worth buying or not. This concept not only helps investors potentially gain more profits but also provides a defensiveness against losses.

His intrinsic value calculation works on this formula:

Intrinsic value = EPS × (8.5 + 2 x Expected Growth Rate) x 4.4 / Corporate Bond Yield

Limitations of Graham Formula

There are three problems with calculating intrinsic value using the Graham formula, which can often lead investors to miss out on good investment opportunities and incur losses.

Warren Buffett pointed out that Graham significantly ignored a company's future growth. For instance, it is unwise to overlook the growth potential of tech stocks due to technological and digital shifts.

In finance, ratios and models have evolved over time. Today, the stock market has many new, effective, and more accurate ratios than older. Therefore, most investors focus on new metrics like ROCE, PEGY, EBITDA, PEG, and operational cash flow. Since this formula follows older metrics, there might be significant differences in the results.

Graham's formula is accurate only for growth stocks. Here, a growth stock is one that generates continuous positive cash flow, with revenues and earnings expected to increase at a faster rate than the average company within the same industry. Therefore, measuring the intrinsic value of low-growth or high-risk debt companies using this formula and making investment decisions based on those results can be risky.