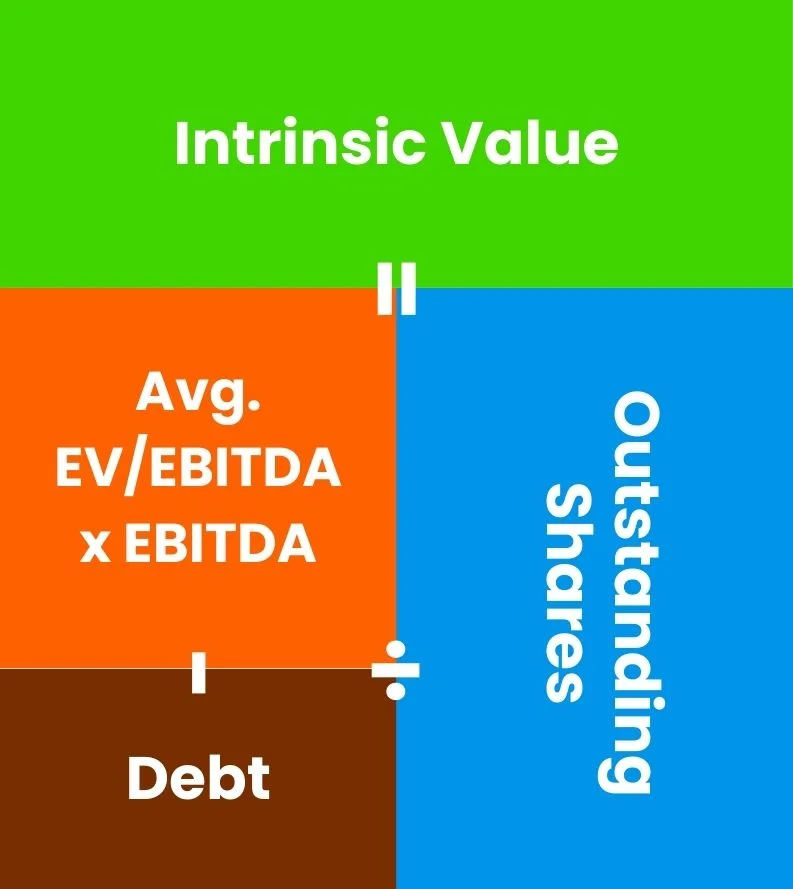

Intrinsic Value By EV To EBITDA Ratio

This calculator computes the intrinsic value of a stock by utilizing the company’s key parameters such as EBITDA, Total Debt, and Outstanding Shares. Where, EBITDA is a crucial metric that indicates the profitability of a company, making it a vital factor for any business to sustain its operations.

Valuation

Frequently Asked Questions

The Enterprise Value (EV) metric is crucial for accurately assessing a company's total financial worth. While market capitalization provides a similar measure, EV offers a more precise valuation.

This is because EV considers the debt of the company that fuels its growth, which is essential for understanding the true value of any well-established company. It excludes highly liquid assets such as short-term investments and marketable securities, which are less relevant metrics in this context.

It can be calculated in multiple ways, such as

Formula 1. Enterprise Value (EV) = Market Capitalization + Total Debt – Cash and Equivalents

Formula 2. Enterprise Value = EV/EBITDA x EBITDA

Formula 3. EV = Common Shares + Preferred Shares + Market Value of Debt + Noncontrolling Interest – Cash and Equivalents

Mostly, stable, old, and large-cap companies provide good and consistent dividends to their shareholders. Stocks with consistently higher dividend yields are also called value stocks.

Disadvantages:

- Not useful for industries that need High-debt.

- It includes total debt but does not show how well the company utilizes the debt.

- Can fluctuate significantly with market conditions.

- Does not account for significant non-operating assets.

EBITDA stands for Earnings Before Interest Taxes Depreciation and Amortization. It focuses on the core operating performance of a company by excluding its capital investments, including plant, property & equipment and expenses related to debt. This allows for a clearer view of how well the business itself is performing.

There are two formulas to calculate EBITDA.

Formula 1: EBITDA = Net Profit + Interest + Taxes + Depreciation + Amortization

Formula 2: EBITDA = Operating Income + Depreciation + Amortization

Disadvantages:

- Does not include capital expenditures necessary for growing the business.

- Not useful for asset-heavy companies as it excludes non-cash expenses.

- Excludes taxes, which can be a real cost to the business.

- Can be manipulated by excluding certain expenses to make financial performance appear better.

- Not as transparent as cash flow.

The EV/EBITDA ratio is a helpful measure to determine if a company is priced below or above its earnings potential. A lower EV/EBITDA ratio usually suggests that the company might be undervalued.

Disadvantages:

- Not suitable for all industries.

- The ratio doesn't consider the growth rates of companies.