Some people call the stock market a business while some consider it speculation. what do you believe? Today, the stock market has become a very popular investment alternative among people due to high returns and good liquidity.

According to statistics, nearly 61% of adults in the United States invest in the stock market, which is the highest in the world. Over the past 25 years, gold has given an average annual return of 2.6% and real estate 5.4%, while the stock market has delivered the highest 9.6% return annually.

The stock market is still a new place to many, but it officially formed around 1602 with the Amsterdam Stock Exchange. So with this blog, let's explore the fascinating history of the stock market and its profound impact on society.

Stock Market: History, Key Milestones, Crashes And Future Outlook

Origins of the Stock Market

Early forms of stock trading: In the ancient civilization of Mesopotamia, we find traces of early unauthorized stock trading practices governed by the Code of Hammurabi. Moving forward to ancient Greece and Rome, public marketplaces served as meeting points for the trading of shares of various enterprises.

The inception of modern stock trading: In the early 1600s, the Amsterdam Stock Exchange emerged as a major player that provided a regulated platform for investors. Then, London and Paris also adopted this idea and set up their own stock trading centers.

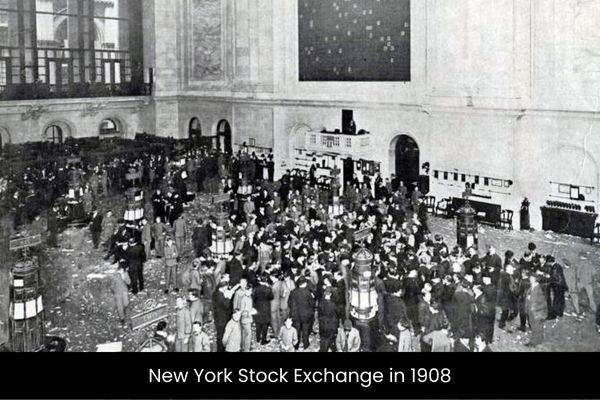

Evolution of Stock Exchanges

The New York Stock Exchange (NYSE): Wall Street, the iconic financial district and formation of the NYSE, assumes a central role in American financial history. The NYSE's foundation marks a milestone in the development of stock exchanges, bringing transparency and standardized practices to the market.

Rise of other stock exchanges: Europe witnesses the emergence of stock exchanges in major financial centers, including London and Frankfurt, contributing to the region's economic growth.

Key Milestones And Market Crises

Industrial Revolution: The industrial revolution spurred the growth of corporations that eventually increase the share prices and the stock market rose sharply. Hence, increasing liquidity in money markets, railroads and industrial giants became dominant players, driving economic progress and shaping the landscape of the stock market.

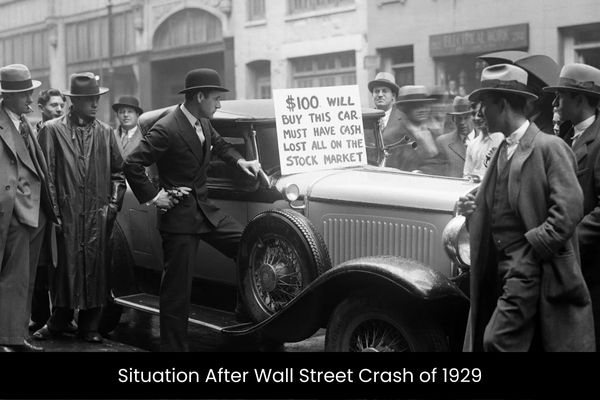

The great depression: The stock market crash of 1929 is also known as "Black Tuesday" and the "Wall Street Crash". The crash caused a worldwide economic depression and reduced public confidence in the market.

Practically, there were two main reasons behind this crash. Firstly, loans were easily available in those days to buy stocks, which increased the scope for speculation in the market and secondly, the stock market was not much regulated by the government.

Hence, learning from this crash, new regulatory reforms were implemented by the government to overcome such difficulties, which restored stability in the market and helped prevent future crises.

Dot-com bubble: The internet revolution in the late 1990s gives rise to the dot-com bubble. During that time, the tech stocks soared to new heights. In the early 2000s, the bursting of the dot-com bubble highlights the importance of valuation and sustainable business models.

The global financial crisis of 2008: The collapse of the mortgage market in the US triggers a severe financial crisis, causing a ripple effect across global stock markets. Governments and regulatory bodies undertake significant measures to stabilize the markets.

Stock Market in the Modern Era

Technological innovations, such as digital trading systems and electronic exchanges, revolutionize the way stocks are traded. It makes transactions faster, more efficient and secure.

Regulatory bodies, such as the Securities and Exchange Commission (SEC) and National Stock Exchange (NSE), play a crucial role in safeguarding market integrity. Also, International organizations collaboratively establish standards and regulations to foster stability and transparency in global stock markets.

Current Trends And Future Outlook

Rise of online trading platforms and retail investors: Over the past few years, retail investors have been heavily influenced by social media, movies and online advertising. Because of this, a large number of retail investors started investing and trading in the stock market.

Mutual Funds: It is a unique and effective way to enter in the stock market. Mutual Funds help common people to safely invest in the market. With the facility of SIP in it, one can reduce risk and get good returns by investing every month with very little capital. Due to all these reasons, mutual funds have become a very popular investment option among people.

Algorithmic trading and AI evolution: Trading algorithms and artificial intelligence revolutionize trading practices, enabling faster decision-making and increased market efficiency.

With chatGPT, we can think of countless possibilities which can give a new direction to the stock market in the future.

Conclusion

These were the stories from its inception to the present day! Here, we'll uncover numerous mistakes that we can learn from to prevent future losses. Remember, it's crucial to view the stock market as a business rather than a mere speculation. So understand a business first and be a smart investor. If you want to engage in trading, it is essential to first learn all the necessary strategies and then proceed with caution, minimizing risks.

References: