We always gather information about any product before making a purchase, especially its specifications and details. However, when it comes to investing in mutual funds, many people only look at ratings and past returns, which can prove to be a huge mistake.

In investing, there's a quote: “Investing without research is like driving with your eyes closed.”

Have you ever driven with your eyes closed? Of course not. Then you should not invest in mutual funds without doing research. You may find this task a bit difficult. But we can do this research very easily with the right guidance and a step-by-step approach.

So in this blog, I have put some essential points in which you will be able to pick the best mutual fund and get maximum return with less risk. So let's see what these points are.

12 Things To Consider In Choosing Mutual Funds

1. Financial Goals:

Financial goals are simply objectives you want to achieve with your investments. It gives direction to your investment strategy and helps you determine how much money you need to save and invest.

Defining your financial goals helps you gain clarity about what you want to achieve. For example, your goals could be to buy a house, pay for your child's education, or retire comfortably. Knowing these goals helps you plan your investments accordingly.

2. Risk Tolerance:

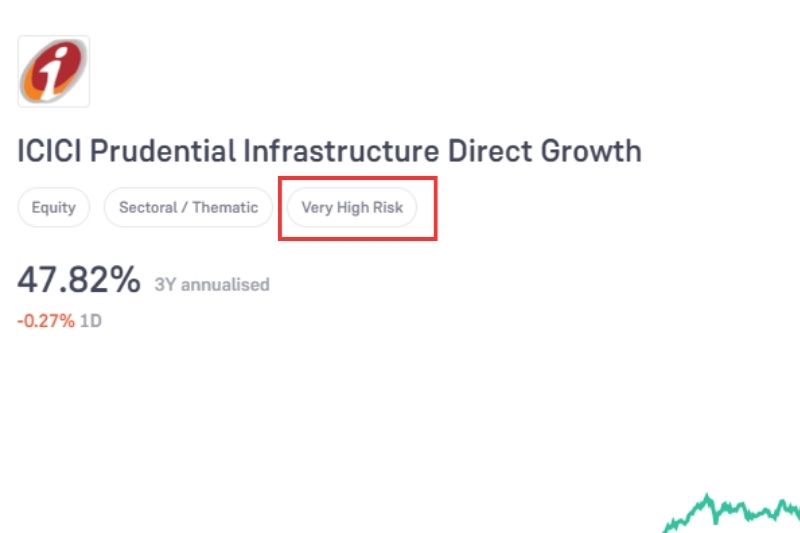

Risk tolerance is like a measure of your comfort level with the possibility of losing money on your investments. It helps you to determine the types of funds that are suitable for your goals.

Imagine a spectrum of risk, with low-risk investments like bonds on one end and high-risk investments like stocks on the other. Your risk tolerance is where you fall on this spectrum. Some people are comfortable taking more significant risks to potentially earn higher returns, while others prefer more stability, even if it means lower potential gains.

3. Investment Horizon:

Your investment horizon refers to the length of time you plan to hold your investments, particularly mutual funds. Different financial goals have varying timeframes. For example, you might be saving for a down payment on a house in the next 3 years, your child's college education in 10 years, or your retirement in 30 years. Your investment horizon should align with these goals.

The length of your investment horizon is also closely related to your risk tolerance. If you have a longer horizon, you may be more comfortable with investments that have higher volatility, such as stocks, because you have time to ride out market ups and downs. Shorter horizons may necessitate more conservative investments like bonds or money market funds to protect your capital.

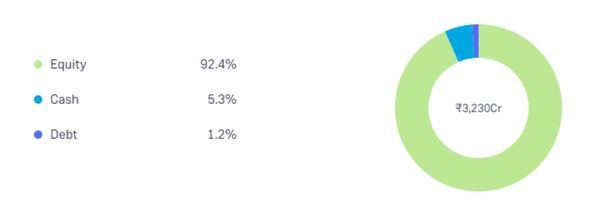

4. Asset Allocation:

Asset allocation is a strategy that involves spreading your investments across different asset classes, such as stocks, bonds, and cash, to help achieve your financial goals while managing risk.

It is like not putting all your eggs in one basket. When you invest in mutual funds with different asset classes, you spread your risk. If one asset class underperforms, the others may help balance out your portfolio's overall returns.

5. Investment Style:

Investment style refers to the approach or strategy that a mutual fund manager uses to select and manage investments within the fund's portfolio.

Mutual funds can follow various investment styles, each with its unique characteristics. The three primary investment styles are:

Value: Value-oriented funds seek stocks or assets that are undervalued or trading below their intrinsic worth. These funds typically focus on companies with strong fundamentals but low stock prices.

Growth: Growth-oriented funds aim to invest in companies with the potential for rapid earnings and revenue growth. They often target companies in innovative industries.

Blend (or Core): Blend funds combine elements of both value and growth strategies, offering a balanced approach that may appeal to a broader range of investors.

6. Fees and Expenses:

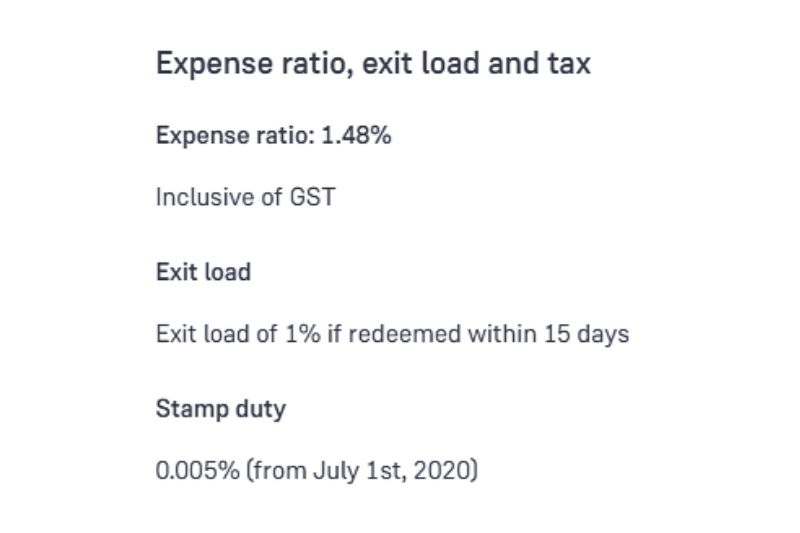

Fees and expenses are the costs associated with investing in mutual funds. These costs can significantly impact your investment returns.

Expense Ratio: The expense ratio is the most common fee associated with mutual funds. It represents the annual cost of managing and operating the fund as a percentage of the fund's assets. For example, if a fund has an expense ratio of 1%, it means you'll pay ₹10 per year for every ₹1,000 you invest in the fund.

Types of Fees: In addition to the expense ratio, mutual funds may charge other fees, such as sales loads, redemption or purchase fees. These fees can vary widely between funds and can affect how much you pay when you buy, sell, or hold the fund.

7. Historical Performance:

See the past returns and results of a mutual fund over a specific period, typically measured in years. It's one of the basic factors investors often consider when evaluating mutual funds.

Reviewing a mutual fund's historical performance can provide insights into how it has performed in different market conditions. Look at a fund's performance over various timeframes, not just the most recent years. It helps you gauge whether the fund has met its investment objectives in the past.

Note: But keep in mind that past performance is not a guarantee of future results. A mutual fund that performed well in the past may not continue to do so. Market conditions and fund management can change over time, affecting performance.

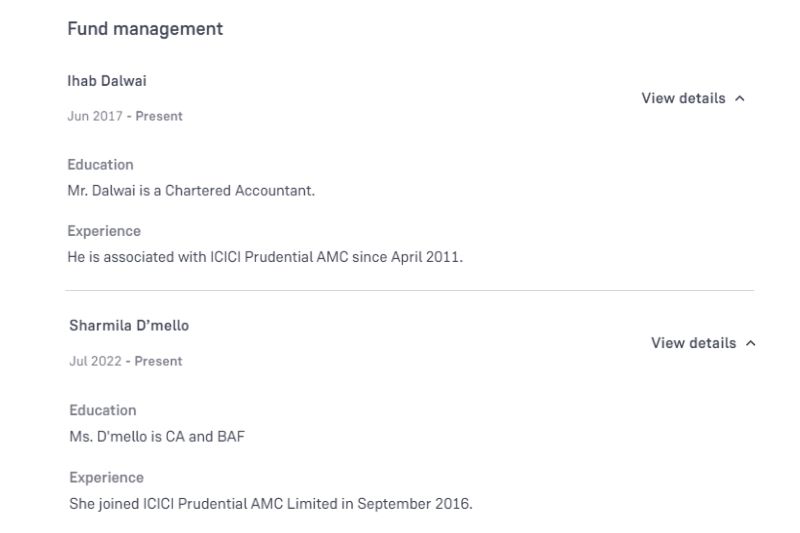

8. Fund Manager:

Fund managers play a pivotal role in the fund's success and how it's managed. Learning about the fund manager's experience and evaluating a fund manager's track record involves looking at their past performance managing similar funds. This can provide insights into their ability to generate returns and manage risk over time.

Consistency in decision-making and strategy execution is also essential. A fund manager who consistently applies their strategy and produces steady, reliable returns may be preferred by investors looking for stability.

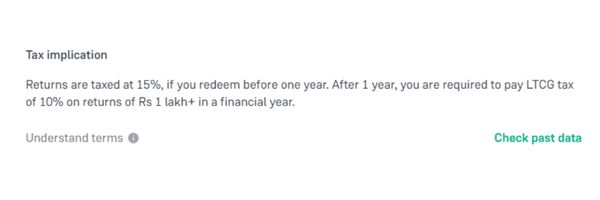

9. Tax Implications:

Learning the tax implications of your mutual fund investments is important because it can impact your overall returns. Mutual funds generate capital gains (profits from buying and selling investments) and may also distribute dividends (earnings from investments like stocks or bonds). These gains and dividends are typically taxable in the year they are received.

Remember, buying or selling mutual fund shares can also affect your tax liability. If you sell fund shares at a profit, you may owe capital gains taxes. The length of time you hold the fund shares (short-term or long-term) can affect the tax rate.

10. Exit Strategy:

An exit strategy is a personalized plan that guides how and when you will sell your mutual fund investments to meet your financial objectives. It helps manage risk. For example, it may include setting predefined exit points or triggers to sell if the fund's performance deviates significantly from your expectations or if the market experiences unexpected volatility.

Also, it's important to regularly review and adjust your exit strategy as your financial goals, risk tolerance, and life circumstances change. What works today may not be suitable in the future.

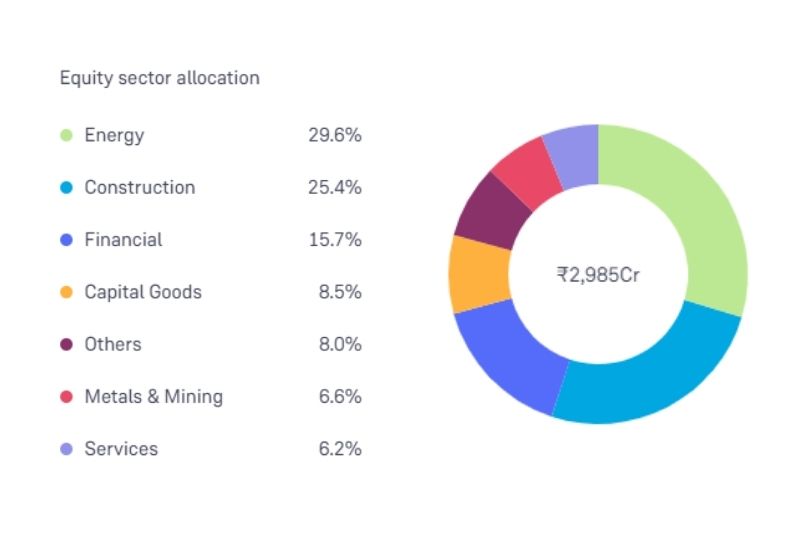

11. Holding Analysis:

Holding analysis helps assess the risk level of the fund. For example, if a mutual fund holds a significant number of high-risk, volatile stocks, it may be riskier than a fund with a more conservative mix of assets.

It also provides information about the fund's exposure to specific industries or sectors of the economy. For instance, you can see if the fund has a heavy weighting in technology, healthcare, or financial services stocks. This knowledge can help you evaluate whether the fund aligns with your sector preferences.

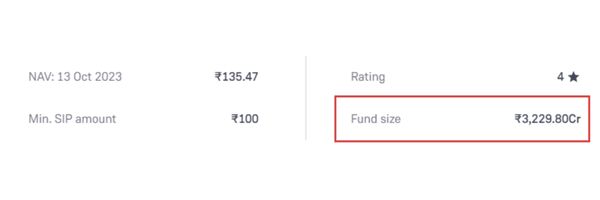

12. Fund Size:

Fund size refers to the total amount of assets under management (AUM) in a mutual fund. It represents the combined value of all the investments held within the fund.

In some cases, very large funds may have difficulty achieving outsized returns because they are limited in their ability to invest in smaller, high-growth opportunities. Conversely, smaller funds may have the potential for higher returns but may also come with higher risks.

On the other hand, larger funds can benefit from economies of scale. They may have lower expense ratios because they can spread the cost of management and operations across a larger asset base. Lower expenses can lead to higher returns for investors.

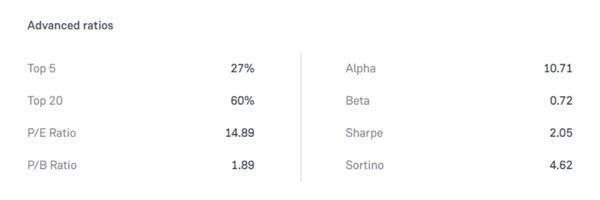

12. Financial Ratios:

Financial metrics and ratios that go beyond the basic performance indicators to provide investors with a more detailed understanding of a mutual fund's characteristics. Here are a few examples:

Sharpe Ratio: The Sharpe Ratio measures a fund's risk-adjusted return. It evaluates how well a fund has performed relative to the risk it has taken. A higher Sharpe Ratio suggests a better risk-adjusted performance.

Treynor Ratio: Similar to the Sharpe Ratio, the Treynor Ratio assesses risk-adjusted returns. However, it focuses on how well a fund has performed in relation to market risk, often measured by beta. A higher Treynor Ratio indicates better performance for the level of systematic risk.

Sortino Ratio: The Sortino Ratio evaluates risk-adjusted returns but places more emphasis on downside risk. It considers how well a fund has performed relative to its downside volatility, helping investors assess a fund's ability to protect against losses.

Tracking Error: Tracking Error quantifies the deviation in a fund's performance from its benchmark index. A higher tracking error indicates that the fund's returns are more variable than the index, potentially reflecting a more active management style.

Alpha and Beta: Alpha measures a fund's risk-adjusted excess return relative to its benchmark, while Beta assesses its sensitivity to market movements. Understanding these metrics can provide insights into a fund's unique performance characteristics.

Final Words

These are some factors that you should consider before investing in mutual funds. Once you find your top 5 or 7 mutual funds, don't forget to compare them. Additionally, it's important to maintain diversity in your investments, such as in index funds, debt funds, and ELSS for tax-saving purposes.

By doing so, you can achieve a balance between safety and high returns, ensuring that your money remains accessible in case of financial emergencies without incurring losses.

You May Also Like: