Does living a debt-free life seem like a dream? Then this blog is for you. I’ll share steps to help you clear your debt while investing for the future.

The only condition is that your monthly income must be higher than your debt. If it is not, you have two options: reduce your debt or increase your income. There's no magical solution beyond these.

If your income exceeds your debt, continue reading.

First, we'll start from the basics. Just as it's essential to understand a disease before treating it, it's crucial to grasp the fundamentals before addressing any issue. So we'll start by understanding debt, its basic types, and how to manage them effectively.

Understanding Debt:

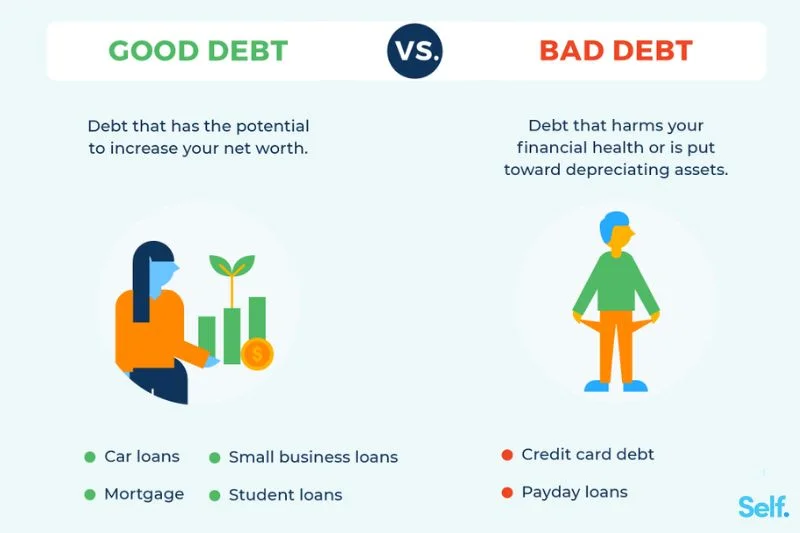

Debt generally falls into two categories: good debt and bad debt.

Good debt: This is typically an investment you made for your future. Examples include loans for higher education, mortgages, and business loans, etc. These types of debt often have relatively low interest rates and can contribute to long-term wealth-building opportunities.

Bad Debt: This type of debt is usually associated with purchases that provide no long-term benefit. Examples include credit card debt, high-interest personal loans, and auto loans. Bad debt can quickly spiral out of control if not managed effectively, leading to financial strain and restricting your ability to invest for the future.

Now, let's explore some strategies for managing debt while still prioritizing investments.

6 Essential Steps for Managing Debt and Investing Wisely

1. Create a Financial Plan:

Begin by evaluating your current financial situation and setting clear goals for both debt repayment and investing. Here’s how to get started:

1. Check The Current Financial Situation: Calculate your monthly income, expenses, unpaid or ongoing loans, and available assets.

2. Set Clear Goals: Decide on your priorities for paying off debt and investing.

3. Create a Budget: Use the information from your financial assessment to make a realistic budget. Allocate money toward debt repayment and also set aside funds for investments.

This approach helps you manage your finances effectively, ensuring you can pay down debt while still investing for your future.

2. Prioritize High-Interest Debt:

If you have multiple loans, focus on paying off those with the highest interest rates first, like credit cards or high-interest personal loans.

By targeting these debts, you'll reduce the amount of interest you pay over time. This will free up more money for investments once the high-interest debts are paid off.

3. Simplify Debt Management:

Converting a high-interest loan into a single, lower-interest loan can help you manage your debt more efficiently.

You could transfer your credit card balances to a card with a lower interest rate or take out a personal loan to pay off multiple debts. Just make sure to carefully review the terms and fees of any consolidation option before you proceed.

3. Maintain Emergency Savings:

While it's important to prioritize debt repayment, don't forget to build an emergency fund. Having savings for unexpected events or expenses can keep you from using credit cards or loans during financial emergencies.

Aim to save at least 3 to 6 months' worth of living expenses in a bank account.

4. Maximize Retirement Plans:

If your employer offers a retirement plan with matching contributions, make sure to take full advantage of it. Contribute enough to get the maximum employer match—this is free money that can boost your long-term savings.

Plus, contributions are usually taken directly from your salary, making it easier to save consistently.

5. Consider Low-Risk Investment Options:

While paying off high-interest debt, don't overlook the importance of investing. Look into low-risk investment options like index funds, mutual funds, or bonds.

These investments can offer steady returns without much risk and can provide passive income while you focus on paying off your debt.

6. Review & Adjust Regularly:

As your financial situation changes, regularly review your debt repayment and investment strategies to make sure they still match your goals and circumstances.

If you get extra money or a raise, consider using some of it to pay off debt faster or to invest more. If you face unexpected expenses or changes in income, adjust your plan accordingly to stay on track.

Now It's Your Turn

Managing debt while investing for the future requires careful planning, discipline, and commitment. But if you follow all the steps in this blog sincerely, you can clear your debt easily and enjoy a peaceful life with financial stability.

Remember, buy more assets than required and have less liability than needed. This approach will help you avoid unnecessary expenses and become debt-free sooner. Have a debt-free life!

You May Also Like: