In today’s digital age, investing in stocks, bonds, or startups has become quite easy. However, amid all these options, "Gold" has maintained its significance.

Because gold symbolizes wealth, power, divinity, and immortality.

Thomas Hood well said about gold in one of his poems…

Gold! gold! gold! gold!

Bright and yellow, hard and cold,

Molten, graven, hammer'd and roll'd;

Heavy to get, and light to hold.

Holding onto gold is quite challenging, and even more difficult is owning it. This is because its price has increased by approximately 11% to 14% per year over the past 20 years.

However, due to the growth of the fintech industry, there are now several options available through which one can invest in gold with a relatively small amount in just a few minutes. So, let's delve into the details of why invest in gold and how.

The History of Gold

We always delve into the history of any asset or company before investing in it. So, let's first understand the history of gold.

Early Discoveries:

Evidence found in Bulgaria indicates that the history of gold dates back to at least 4000 BC. By 3000 BC, Egyptians began using it for decorative and religious purposes.

As time progressed, around 2500 BC, the skill of goldsmithing developed, and people started using gold for jewelry and ornaments.

Gold's Rise as Currency:

In the exchange of goods, people faced transparency issues, leading Egypt to adopt gold as the official medium of exchange around 1500 BC. Later, Lydian merchants introduced gold coins around 700 BC, becoming the world's first currency in gold form.

By 500 BC, major civilizations like Greece, Persia, and Rome also accepted this payment system.

Between 1400 and 1750, European countries recognized the importance of gold, leading to the exploration of gold in various countries with the slogan "Gold, God, and Glory" to influence economic prosperity and global trade patterns.

Modern Era:

In the 19th century, the Gold Standard was introduced to maintain the value of the paper currency. It involved keeping specific amounts of gold in reserve before printing any paper currency. Today, gold plays a crucial role in balancing the world's currencies.

The following quote illustrates this idea:

Gold is the great balancing wheel of the world's trade.

Why Invest In Gold?: The 5 Key Reasons

Reason 1: The Real Value

Looking at the history of gold, it is evident that it possesses a real value. Besides, it has a limited supply, and obtaining it involves significant costs, making its true worth apparent.

Mining 1 ounce, which is approximately 28 grams of gold, costs around $500 to $2,000. Currently, the price of 28 grams of gold is $1,804. Hence, it is clear that its real value is around this range.

JP Morgan also acknowledges the value of gold, which is why they say...

Gold is money, everything else is credit.

Reason 2: Hedge Against Inflation

Inflation, which means the increase in the cost of living, impacts middle and lower-class individuals the most. The primary cause of inflation is the overprinting of paper money. Additionally, obstacles in demand and supply, such as those experienced during COVID-19, can also contribute.

So the safest option to survive against inflation can be gold. Because gold has historically been a good hedge against inflation, meaning that its price tends to increase when the cost of living goes up. This is because gold is a tangible asset that cannot be inflated away like paper money.

Reason 3: Safe Haven Asset

Commodities such as gold have a world market that transcends national borders, politics, religions, and race.

Gold is often seen as a safe haven asset because its price tends to increase during economic or political uncertainty or wars. So many investors view gold as a relatively safe place to store their wealth during turbulent times.

Reason 4: Useful For Portfolio Diversification

Gold is a relatively uncorrelated asset. So its price does not move in sync with other asset classes, such as stocks and bonds. This can help to diversify your portfolio and reduce your overall risk.

In most scenarios, it has also been observed that when the stock market goes down or experiences a crash, the price of gold tends to rise. This allows you to reduce your losses and avoid the challenges of being compelled to sell stocks during times of a down market.

These are some quotes that shed light on what the world's greatest investors say about portfolio diversification and gold.

Gold is like insurance, should not be viewed as an investment, but rather as protection against unforeseen events.

Gold is the currency of heaven. The gold standard is the only anchor which will prevent the financial system from drifting into utter chaos.

Reason 5: Tangible Asset

Unlike stocks and bonds, which are essentially pieces of paper, gold is a tangible asset. That means it has a physical presence and cannot be easily destroyed.

As we have seen before, the mining of gold also requires various resources and capital. Therefore, not everyone can mine it, leading to a limited supply of gold. This limited supply, coupled with higher demand, further increases its value.

This can be appealing to investors who are looking for a safe place to store their wealth.

In a world of paper promises, gold possesses a tangible reality that is both immutable and irresistible.

How Safe Is Investing In Gold?

There is no such thing in the world where there is no risk involved in investing, be it stocks, businesses, properties, or even gold.

We have seen that gold is one of the easiest and safest assets to invest. However, even investing in gold, there are its disadvantages. Although solutions to almost all of these cons exist, which I will also discuss with you.

1. Price Volatility:

The price of gold can fluctuate significantly in the short term, leading to potential losses.

In addition to volatility, there is also a significant possibility of gold prices remaining stable for several years. For example, from 2020 to 2023, gold has shown a return of only 0 to 1%. Therefore, it is recommended to hold gold for the long term or until a market crash occurs.

Solution: No Solution

2. No Other Income:

When we invest in a stock, it provides us with passive income in the form of dividends. In addition, we also receive additional income as an interest in fixed deposits (FD) and savings accounts.

However, in the case of gold, the benefit comes from the increased price, and it does not generate other income like dividends or interest.

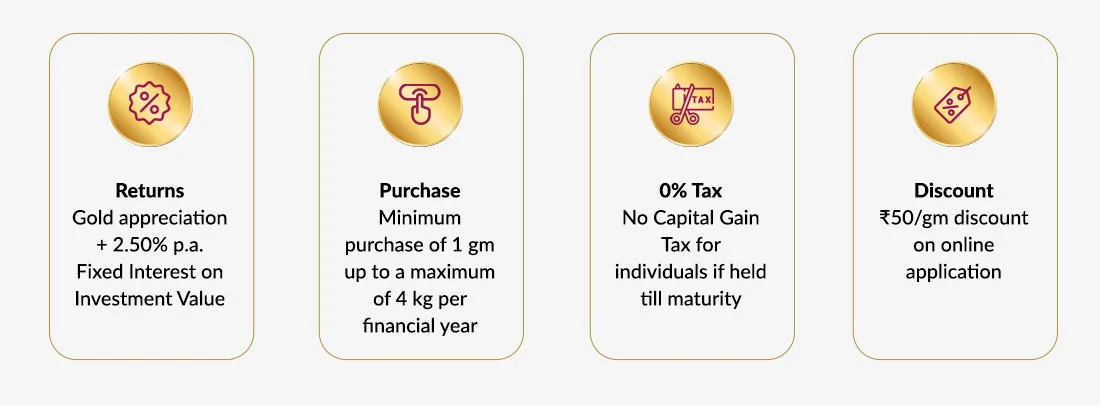

Solution: Sovereign Gold Bond Scheme. In this scheme by the Indian government, you not only receive tax benefits along with gold price appreciation but also get a fixed return of 2.50% on invested gold.

3. Storage Costs:

After purchasing gold, storing it safely is equally challenging. If there is a large quantity of gold, we have to bear charges for keeping it in a locker. Despite all this, the risk of theft is also quite high.

Solution: Digital Gold, Gold ETFs, Sovereign Gold Bond Scheme. These three are digital assets of gold, by investing in them you can avoid the trouble of storing physical gold safely.

4. Limited Liquidity:

Selling gold is even more challenging than buying it. First, the gold is checked, and then its price is determined based on the market price. In this process, we also have to pay money as taxes.

This process takes a considerable amount of time, and even then, there is no guarantee that we will get the right price for our gold.

This makes it quite difficult for us to quickly get money by selling gold when needed.

Solution: Digital Gold, Gold ETFs. These are two digital assets of gold where you can potentially have good liquidity. You can easily buy or sell them.

Final Words

As we have seen, gold is not just a symbol of value but also purity and greatness. It implies true quality, strength, or authenticity. Chinese proverb also supports this.

Real gold is not afraid of the melting pot.

The reputation, significance, and history of gold all clearly give us a green signal to invest in it. German philosopher and economist Karl Marx even said about Gold that "Gold is not by nature money, money is by nature gold." So if you invest in gold at least 5% of your portfolio, then it is one of the wisest decisions that you can make as an investor.

If you also have any facts related to gold to share, please do share them with me.

You May Also Like: